In today's evolving voluntary carbon market, the need for high-quality projects and trustworthy partners is more critical than ever. For businesses, understanding and implementing these high standards can lead to more effective sustainability strategies, enhanced brand reputation, and increased stakeholder trust. This summary distils insights from our recent webinar on how to navigate this complex landscape, ensuring your investments not only meet your sustainability goals but also deliver genuine, measurable impact. Below, we break down the key takeaways discussed during the webinar.

What Makes a High-Quality Carbon Credit?

High-quality projects are the foundation of high-quality carbon credits. Quality in carbon credits goes beyond just the absence of risk; it’s about how well projects manage inherent risk. Quality projects ensure that the environmental and social impacts delivered are both real and measurable. Here are the fundamental criteria that define a high-quality carbon credit:

- Real: The project’s impact must be observable in the world.

- Measurable: Robust carbon calculations and data transparency are crucial.

- Additional: The project must prove it wouldn’t have proceeded without carbon credit funding.

- Permanent: Ensuring long-term carbon storage and mitigating reversal risks.

- Unique: Preventing double counting of credits.

- Risk-managed: Incorporating comprehensive risk management and safeguards.

- Independently verified: Adherence to international carbon standards.

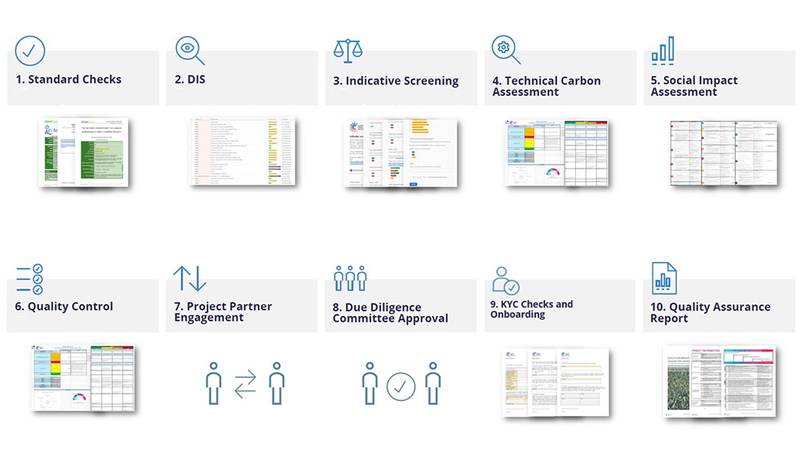

Quality Assurance: Ensuring Projects Deliver

To ensure we only work with top-tier projects, we implement a meticulous 10-stage Quality Assurance process. This involves everything from standard checks and derogatory information searches (DIS) to detailed technical carbon assessments and continuous quality assurance. Some of the features include:

- Standard Checks: Projects must be registered and audited against approved international carbon standards.

- Derogatory Information Search (DIS): Conducted to uncover any negative media, legal issues, or other red flags associated with the project or its developers.

- Know Your Customer (KYC): A thorough assessment covering 30 risk categories and using data from over 60 million entities. This includes sanctions and watch lists, politically exposed persons (PEPs) and their associates, adverse media, and ownership profiles.

Selecting and Working with Project Partners

Choosing the right project partners is as crucial as selecting the projects themselves. Here are the key attributes we look for:

- Operational Capacity and Track Record: Partners must demonstrate the ability to manage and scale projects effectively.

- Appropriate Data and MRV Practices: Reliable data and robust monitoring, reporting, and verification (MRV) practices are non-negotiable.

- Alignment with Our Values: Partners should share our commitment to quality, transparency, and impact.

- Local Engagement: Effective local engagement and positive community impacts are essential.

- Willingness to Build a Meaningful Relationship: We aim for more than transactional relationships; we seek meaningful partnerships. This involves ongoing communication, regular site visits, and collaborative problem-solving to ensure project success and integrity.

Ensuring Quality in Carbon Project Portfolios

Maintaining a high-quality carbon project portfolio requires diligence and strategy. Here are six steps to ensure quality:

- Purchase Verified Projects: Only buy credits from projects verified to international standards.

- Understand Project Types: Be aware of the various project types and their specific impacts.

- Consider Project Location: Geographic diversity can enhance the robustness of your portfolio.

- Diversify Your Portfolio: A mix of project types and locations can mitigate risks.

- Budget Accordingly: Quality is often linked to higher cost, but not always. A higher price can also facilitate delivering greater impact.

- Regular Reviews: Continuously monitor and review your portfolio to ensure it meets evolving standards and goals.

Contact our team

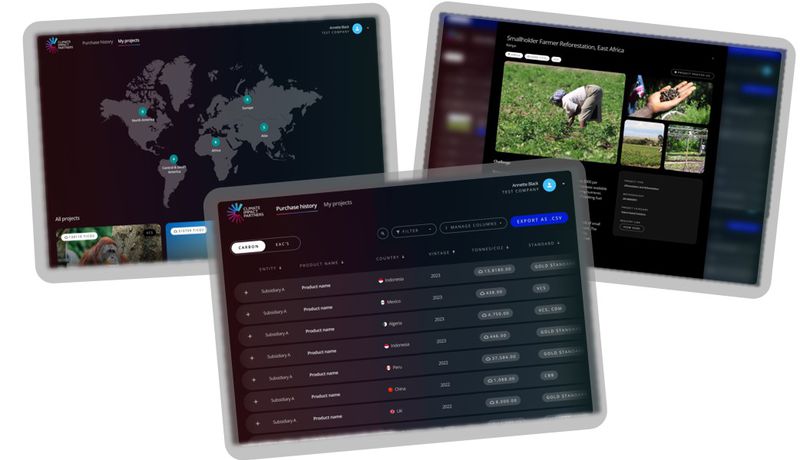

Innovative Tools for Management and Reporting

Our client dashboard offers real-time data on past transactions, an overview of client portfolios, project details, and more. This ensures transparency and ease of reporting for our clients' carbon programs.

We are actively developing the functionality of the dashboard to increase its utility for our clients and partners.

Guaranteeing the quality of your carbon credits and selecting the right partners are essential steps in your climate action journey. By applying the insights and strategies discussed, you can navigate the voluntary carbon market with confidence, making impactful investments that achieve real, measurable change.